Unify Your

Practice, Elevate

Your Value.

Unify Your

Practice, Elevate

Your Value.

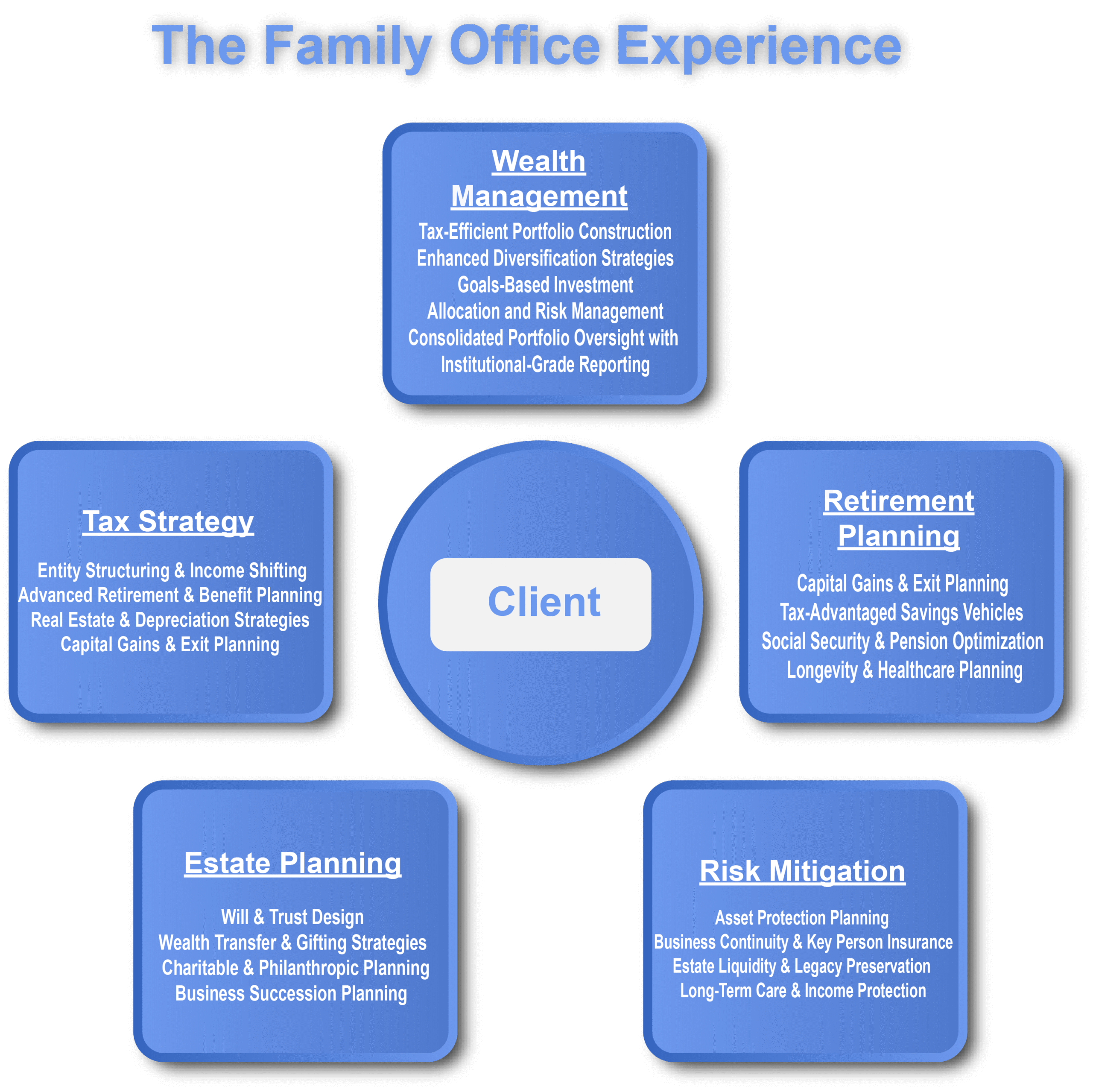

At Intellivisor Family Office, our mission is to empower families, business owners, and real estate investors with integrated, forward-thinking financial solutions. We deliver personalized guidance across tax planning, estate and trust structuring, risk-based wealth management, and exit planning—ensuring each client’s legacy is protected, optimized, and positioned for multigenerational success.

Through trusted partnerships, innovative technology, and a collaborative team of experts, we serve as the central advisor in our clients’ financial lives, providing clarity, confidence, and continuity at every stage of wealth.

Empowering Financial Advisors with Scalable Tools, Expert Partnerships, and Integrated Services—from Tax and Estate Planning to Investment Management and Business Growth Training.

Proprietary Advisor Technology

- Income Planning

- Workflow Automation

- Case Design & Meeting Prep

- Practice Analytics & Dashboards

- Built for Efficiency, Designed for Growth

- Case Study: $18,400/year saved & 40 hours/month recovered

Outsourced CIO

- Access Institutional-Grade Investment Management—Without the Overhead

- Managed Portfolios

- SMA/UMA Platform

- Model Marketplace

- Monthly Market Commentary

- Large Case Assistance

Tax Planning

- Integrated Tax Planning That Saves Clients—and Advisors—More

- 1500+ strategies (federal/state)

- CPA + Legal Team Support

- Monetizable Deliverables

- Case Study: Business owner saved 25% in annual taxes

Estate Planning

- Legacy Planning—Simplified, Streamlined, and Profitable for Advisors

- Trusts, Wills, & Total Plans

- Client Analysis Tools

- Document Creation Platform

- Link: Will vs. Trust Quiz

CEO Mindset Program

- Become the Advisor Every Client and COI Trusts

- Personal Coaching

- Monthly Mastermind

- RIA University

- Seminar & Review Training

- Operational Excellence Workbooks

Insurance Agent Partnership

- Give Your Clients the Full Family Office Experience

- Partnered Estate, Tax, and Investment Planning

- Advisors Maintain Client Control

- Back-office and Fulfillment Support

Christian “Gabe” Gabrielsen is a distinguished leader in the financial services industry, bringing over 30 years of expertise in capital raising, strategic leadership, and team management. His extensive career spans key roles, including Senior Executive, National Sales Manager, Regional Leader, and Financial Advisor, where he has consistently driven exceptional results for prominent financial institutions.

Professional Experience

Gabe joined our organization in 2024, bringing a wealth of experience from high-impact positions, including:

- Senior Financial Advisor, Key Bank

- National Sales Manager, Lincoln Financial, Knight Capital, and TNP

- President, The Lightstone Group

- Divisional Sales Manager, The Equitable/AXA and Strategic Capital

Notably, during his tenure at Lincoln Financial, Gabe spearheaded a remarkable growth in annual sales from $400 million to over $5 billion, leading a team of more than 100 wholesalers with strategic vision and operational excellence.

Education and Certifications

Gabe holds a bachelor’s degree from the University of Vermont and is a licensed financial professional, possessing Series 6, 7, 24, 26, 63, and 66 securities licenses.

Personal Life

Residing in Maine with his wife, Joy, and their young son, Hans Christian, Gabe balances his professional achievements with a strong commitment to family. He is also the proud father of two adult children, Sonja and William, both of whom have established successful careers.

Estate Planning

Will & Trust Design

- Structuring wills and revocable/irrevocable trusts to control asset distribution

- Avoiding probate and ensuring privacy

- Designating guardianship and trustees

Wealth Transfer & Gifting Strategies

- Utilizing annual gift exclusions and lifetime exemptions

- Implementing Grantor Retained Annuity Trusts (GRATs), Intentionally Defective Grantor Trusts (IDGTs), and Family Limited Partnerships (FLPs)

- Planning for intergenerational wealth transfers and minimizing estate taxes

Charitable & Philanthropic Planning

- Using Charitable Remainder Trusts (CRTs), Donor-Advised Funds (DAFs), and Private Foundations

- Integrating giving strategies with tax and legacy goals

- Maximizing impact while reducing taxable estate

Business Succession Planning

- Transition strategies for closely held businesses

- Coordinating ownership transfer with estate and tax objectives

- Leveraging life insurance and buy-sell agreements to protect business value

Risk Mitigation / Insurance

Asset Protection Planning

- Shielding personal and business assets from lawsuits, creditors, or unforeseen liabilities

- Use of legal entities (LLCs, FLPs, trusts) and strategic titling

- Umbrella policies and excess liability coverage

Business Continuity & Key Person Insurance

- Protecting the business in the event of death or disability of a key employee or owner

- Buy-sell agreement funding with life or disability insurance

- Maintaining operations and protecting valuation during leadership transitions

Estate Liquidity & Legacy Preservation

- Using life insurance to cover estate taxes or provide liquidity to heirs

- Wealth replacement strategies in charitable planning

- Irrevocable Life Insurance Trusts (ILITs) to remove policies from taxable estates

Long-Term Care & Income Protection

- Planning for healthcare costs in retirement or disability events

- Hybrid life/long-term care insurance solutions

- Disability insurance for income protection during working years

Tax Strategy

Entity Structuring & Income Shifting

- Choosing the optimal legal structure (S-Corp, LLC, C-Corp, etc.) for tax efficiency

- Leveraging income splitting, reasonable compensation, and family employment strategies

- Utilizing management companies or multiple entities to reduce taxable income

Advanced Retirement & Benefit Planning

- Maximizing deductions with Defined Benefit Plans, Cash Balance Plans, and Solo 401(k)s

- Coordinating retirement plans with business income for tax-deferred growth

- Tax-free income strategies using Roth conversions or permanent life insurance

Real Estate & Depreciation Strategies

- Accelerated depreciation and cost segregation for real estate investors

- 1031 exchanges, opportunity zones, and passive loss optimization

- Structuring real estate income to reduce self-employment tax

Capital Gains & Exit Planning

- Minimizing or deferring capital gains using Deferred Sales Trusts, Installment Sales, or Opportunity Zones

- Tax planning for business or property sales

- Timing strategies and charitable planning to reduce overall tax burden

Retirement Planning

Income Distribution & Withdrawal Strategies

- Tax-efficient withdrawal sequencing (Roth, Traditional IRA, brokerage)

- Minimizing required minimum distributions (RMDs)

- Creating sustainable income streams throughout retirement

Tax-Advantaged Savings Vehicles

- Maximizing contributions to IRAs, Roth IRAs, 401(k)s, SEP IRAs, and HSAs

- Leveraging advanced plans like Defined Benefit and Cash Balance Plans for high earners

- Backdoor Roth and Mega Backdoor Roth strategies

Social Security & Pension Optimization

- Timing Social Security benefits for maximum lifetime value

- Coordinating spousal and survivor benefits

- Evaluating lump sum vs. annuity pension options

Longevity & Healthcare Planning

- Planning for long-term care, healthcare costs, and Medicare integration

- Evaluating annuities and guaranteed income solutions

- Ensuring portfolio longevity through proper risk management

Wealth Management

Tax-Efficient Portfolio Construction

- Design investment strategies that reduce tax drag and maximize after-tax returns.

- Key components include:Strategic asset location (tax-deferred vs. taxable accounts)

- Use of municipal bonds, index-based ETFs, and tax-managed funds

- Capital gains harvesting vs. tax-loss harvesting

- Integration of investments with business and estate structures

Enhanced Diversification Strategies

- Broaden investment exposure beyond traditional stocks and bonds to manage volatility and improve long-term outcomes.

- Includes:Allocation to non-correlated assets (e.g., real estate, commodities, infrastructure)

- Smart beta and factor-based strategies

- Structured notes and buffered ETFs

- Tactical tilts based on macroeconomic trends and business cycles

Goals-Based Investment Allocation and Risk Management

- Align investment strategies with personal, family, and business goals while managing downside risk.

- Includes:Liability-driven investing and cash flow matching

- Scenario analysis for business exits, legacy goals, and lifestyle needs

- Risk budget modeling and stress testing across portfolios

- Use of insurance-linked investments or structured products to hedge risk

Consolidated Portfolio Oversight with Institutional-Grade Reporting

- Provide high-level visibility, control, and coordination across complex asset classes and entities.

- Includes:Aggregation of accounts (brokerage, private assets, retirement plans, business equity)

- Unified performance, risk, and fee reporting

- Integration with business cash reserves and operating accounts

- Oversight by CIO or outsourced investment committee

Asset Protection Planning

- Shielding personal and business assets from lawsuits, creditors, or unforeseen liabilities

- Use of legal entities (LLCs, FLPs, trusts) and strategic titling

- Umbrella policies and excess liability coverage

Business Continuity & Key Person Insurance

- Protecting the business in the event of death or disability of a key employee or owner

- Buy-sell agreement funding with life or disability insurance

- Maintaining operations and protecting valuation during leadership transitions

Estate Liquidity & Legacy Preservation

- Using life insurance to cover estate taxes or provide liquidity to heirs

- Wealth replacement strategies in charitable planning

- Irrevocable Life Insurance Trusts (ILITs) to remove policies from taxable estates

Long-Term Care & Income Protection

- Planning for healthcare costs in retirement or disability events

- Hybrid life/long-term care insurance solutions

- Disability insurance for income protection during working years

Here’s a glimpse of who we’re working with. Curious if your institution is on the list?

Drop us a message and let’s find out!

At Intellivisor Family Office, we’ve built more than just a wealth management platform—we’ve created a complete operating system that allows advisors to deliver the type of high-value, holistic planning once reserved for the ultra-wealthy.

While other platforms focus solely on client reporting and aggregation, Intellivisor empowers advisors to serve as a true family office, offering wealth, tax, and estate planning—all under one roof, all financially rewarding to you as the advisor.

What Typical Platforms Offer

A platform for RIAs/IARs/IAs and advisory firms seeking:

- Portfolio aggregation from hundreds of financial institutions

- Automated client reporting and engagement tools (mobile, portal, email updates)

- Billing, rebalancing, and back-office automation

They’ve done a great job helping advisors streamline portfolio operations and improve client communication.

What they don’t offer?

- No Tax Planning for Business Owners

- No Estate Planning

- No In-House CIO

- No ability for advisors to monetize beyond Insurance and AUM

- No true family office infrastructure

- Coaching/training advisors

- No strategies to capture Highly Appreciated Assets & Mitigate 100% of capital gains

Why this Matters to You?

At Intellivisor, we’re not just helping you serve clients better—we’re helping you build a more profitable, more defensible business:

- Deeper Client Loyalty: Clients stay when you’re handling tax, wealth, and legacy

- More Revenue Streams: Get paid for work most advisors give away for free

- Complete Integration: From CRM to financial planning, from analytics to document delivery—everything works together

What You Get With Intellivisor Family Officer?

We’ve taken the best of wealth management tech and layered in two essential services today’s business owners and high-net-worth families demand:

- On average, our platform identifies 20%+ in annual tax savings for our business owner clients

- These savings come from proven strategies including defined benefit plans, entity optimization, asset location, premium-financed policies, and more

- As an advisor, you don’t just identify the savings—you help implement the plan and share in the revenue

- Generate state-specific revocable trusts, wills, powers of attorney, and healthcare directives

- Advisors become the driver of generational wealth strategy

- And yes, you get paid for every estate plan created through the platform